Biotech investment: is the oncology focus coming at the expense of areas with greater need?

Cell and gene therapies are the latest investment trend in the biotech sector. But a Cohesion Bureau analysis* by Julia Schüler and Frank Schwarz, looking at equity financing of global biotech companies over the past five years, reveals that funding may not be flowing to the areas which are costing health services the most.

The international biotech scene could certainly not complain about a lack of interested investors in the past five years. In the period from 2018 to 2022, investors in the USA and China in particular invested record-breaking sums in biotech companies.

Massive amounts of equity funds have poured into the sector, with a total of almost USD 500 billion (including follow-up financing of companies which had already listed) from 2018 to 2022. In order to identify trends, this analysis focuses on the earlier and at the same time high-volume financings, i.e. venture capital (VC) rounds and initial public offerings (IPOs) of more than USD 200 million. The study sample comprises 211 rounds from 173 biotech companies, categorized according to the predominate technology used by the company. Table 1 shows the top 10 financial transactions.

Table 1: Top 10 rounds of the categories venture capital and IPO

| Firma | Million USD | Series | Year | Headquarter | Founding | Technology/Category | Detail | Indication |

| Venture Capital | ||||||||

| Altos Labs | 3.000 | B | 2022 | USA | 2021 | Cell- & Gentherapy | Celltherapy (engineered) | Longevity |

| MGI Tech Co | 1.000 | B | 2020 | China | 2018 | Diagnostic & Analysis | SequencingTechnology | Not applicable |

| Caris Life Science | 830 | B | 2021 | USA | 1996 | Diagnostic & Analisis | Molecular Profiling | Oncology |

| Resilience | 750 | B | 2020 | USA | 2020 | Supportive | Bioproduction | Not applicable |

| Sana Biotechnology | 700 | A | 2020 | USA | 2018 | Cell- & Gentherapy | Celltherapy (engineered) | Oncology |

| Abogen Biosciences | 700 | C | 2021 | China | 2019 | RNA based Therapy | mRNA | Infections |

| Curevac | 640 | F | 2020 | D | 2000 | RNA based Therapy | mRNA | Infections |

| Resilience | 625 | D | 2022 | USA | 2020 | Supportive | Bioproduction | Not applicable |

| Resilience | 600 | C | 2021 | USA | 2020 | Supportive | Bioproduction | Not applicable |

| Ultima Genomics | 600 | A | 2022 | USA | 2016 | Diagnostic & Analysis | Sequencing Technology | Not applicable |

| IPO | ||||||||

| Sana Biotechnology | 676 | – | 2021 | USA | 2018 | Cell- & Gentherapy | Celltherapy (engineered) | Oncology |

| Moderna | 604 | – | 2018 | USA | 2010 | RNA bases Therapy | mRNA | Infections |

| Oxford Nanopore Technologies | 582 | – | 2021 | UK | 2005 | Diagnostic & Analysis | SequencingTechnology | Not applicable |

| Zymergen | 575 | – | 2021 | USA | 2013 | Synthetic Biology | Bioproduction | Not applicable |

| Abcellera | 555 | – | 2020 | Kanada | 2012 | Biologics | Antibodies (Service) | Not applicable |

| Mabwell | 548 | – | 2022 | China / USA | 2017 | Biologics | Antibodies | Not applicable |

| MGI Tech Co | 518 | – | 2022 | China | 2016 | Diagnostic & Analysis | Sequencing Technology | Not applicable |

| Remegen | 515 | – | 2020 | China | 2008 | Biologics | Antibodies | Oncology |

| Recursion Pharmaceuticals | 502 | – | 2021 | USA | 2013 | IT/AI based Therapy | Own Medication-Development | Cardiovascular |

| Legend Biotech | 487 | – | 2020 | USA | 2014 | Cell- & Gentherapy | Celltherapy (engineered) | Oncology |

Data-Source: BCIQ Biocentury Online Intelligence, BIO. ASPEKTE Analysis

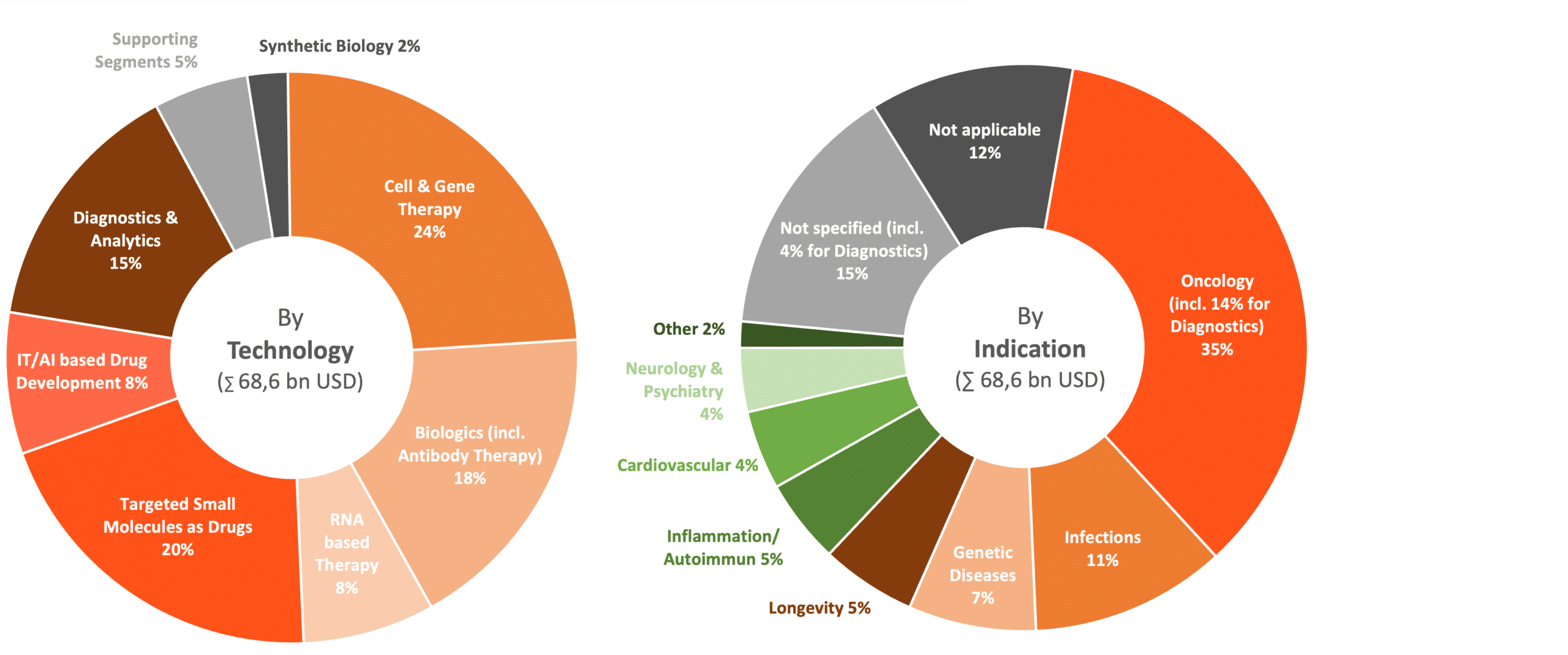

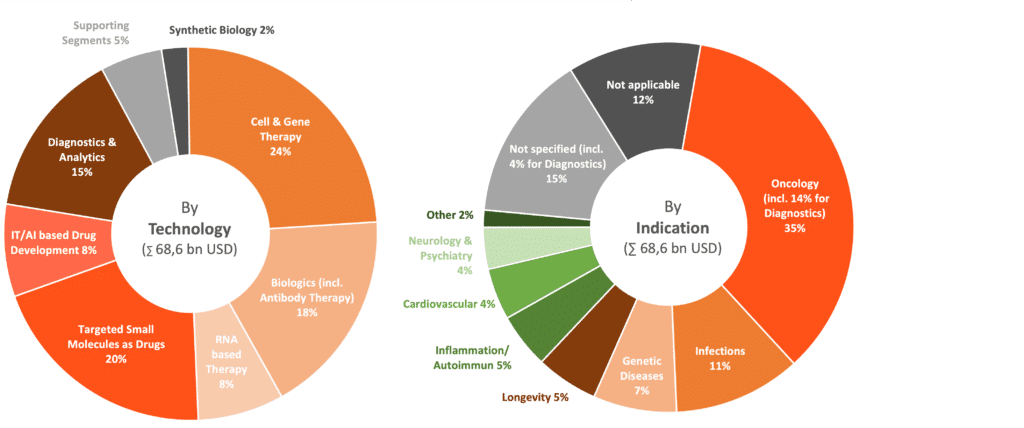

Figure 1: Global biotech VC and IPO financial transactions 2018 to 2022 +

Data-Source: BCIQ Biocentury Online Intelligence, BIO. ASPEKTE. Analysis includes only rounds of more than USD 200 million.

Multifaceted Approaches and AI in the Development of Therapeutics

More than three-quarters of these global biotech investments went to companies developing therapeutics. Classic biotech approaches such as antibody drugs, cell and gene therapies (CGT) and RNA-based active agents are the focus here.

CGT is an increasingly important trend and companies focusing on this area accounted for almost a quarter of the financing under review. Sales forecasts for corresponding therapies already on the market show annual growth rates of around 50% until 2028 – the highest of any biotech technology. The distribution of investments between VC and IPO rounds was relatively balanced overall, although there were clear shifts when looking at individual years: in 2022, for example, there was not a single large IPO in the CGT space, but the US company Altos Labs realized an unprecedented biotech VC round of USD 3 billion to develop cell therapy-based solutions against aging. Otherwise, the focus of financing in this segment was on oncology, with 49%.

In the case of classic biologicals, which primarily consist of antibody technologies with 18% of all financing, it is striking that the companies raised approximately three times more capital via IPOs than venture capital in the period from 2018 to 2022, although across all financing this ratio was 50/50. Is this an indication that this is some kind of mature technology? The distribution is rather reversed for companies focusing on RNA-based drugs, which include antisense oligonucleotides, small interfering RNA (siRNA) and, as further developments of the technology, endless RNA (eRNA) and circular RNA (oRNA). About twice as much VC was invested here as via IPOs, which in principle confirms the even earlier stage of the technology.

A remarkable 20% of the funding went to companies that chemically synthesize targeted small molecules, based on knowledge of the molecular biology of diseases. As no more IPOs took place in the CGT segment in 2022, the largest proportion of these funds was distributed to companies with a small molecule focus, at 49%. In contrast to the innovative CGTs, these have a longer tradition and may therefore offer investors greater security. Overall, the distribution of funds for small molecule companies has also been more in favour of IPOs than VCs over the years.

Another 8% of investments went to companies that rely on artificial intelligence (AI), either to develop therapeutic agents independently or to offer corresponding applications as services. Here, investments peaked in 2021 in the form of eight VC rounds with an average of almost USD 300 million. In addition, there were four IPOs, with an average size just higher than this.

Innovations in diagnostics and analysis as well as in supporting segments.

The Diagnostics & Analysis category includes companies that develop gene sequencing technologies as well as those that perform analyses of biological molecules such as RNA and proteins. These analyses, also known as molecular profiling, provide important insights into disease mechanisms and therapeutic approaches. Examples of high VC rounds here include MGI Tech (sequencing) from China in 2020 with USD 1 billion, and Caris Life Science from the USA in 2021 with USD 830 million. Both were Series B rounds. Overall, the distribution of capital in VC is thus twice as high as in IPOs. Companies from supporting segments such as biomanufacturing (resilience), drug delivery, automation and instrumentation, and drug discovery services also completed significant funding rounds.

Clear focus on oncology in terms of indications

The distribution of investments by medical indications shows that 35% of the funding went to companies specializing in the fight against cancer malignancies. Of this, 14% went to diagnostic solutions for cancer detection. Among therapeutic approaches, CGT companies raised the most capital (34%), followed equally by those in the biologics/antibodies segment (23%) and those with a small molecule focus (23%). Year-by-year analysis reveals that there was a peak in 2020 with 27 oncology IPOs attracting 60% of all IPO proceeds (36% small molecule, 34% biologics, 20% CGT). In the analysis period, IPOs accounted for a total of 45% of all funds in this indication, and only 26% went to VC rounds.

The impact of the Covid-19 pandemic is also visible, as a significant amount of financing (11%) went to companies dealing with infectious diseases. In third and fourth place are investments in companies focusing on the therapy of genetic defects and on aging. The latter, however, was mainly driven by the previously-mentioned super round of Altos Labs. Companies focusing on inflammatory diseases (including autoimmune diseases), cardiovascular problems and neurological-psychiatric disorders received further, clearly recognizable shares.

Does the investment focus on oncology tackle the real cost drivers?

The analysis clearly revealed the strong focus on the part of investors on financing companies that have dedicated themselves to fighting cancer. While the great medical need – especially in individual cases – is very understandable, the real cost drivers at present can be found among completely different diseases. In 2020, cancer was only the fourth most expensive disease in the healthcare systems of both the USA and Germany.

With direct costs of USD 305 billion, the treatment of Alzheimer’s disease is the most expensive in the USA, followed by diabetes at USD 237 billion, cardiovascular diseases at USD 216 billion and then cancer at USD 200 billion (approx. 600,000 euros per citizen). According to the Federal Statistical Office, in Germany the total cost of medical care in 2020 was 432 billion euros, with cardiovascular diseases and mental and behavioural disorders at the top of the list, each accounting for 13% of the total (56 billion euros). Diseases of the digestive system had costs of 47.5 billion euros, and were thus in third place, ahead of oncological diseases at 39 billion euros (approx. 470,000 euros/citizen). Treatments for dementia and depression cost the nation around 20 billion euros and just under 10 billion euros respectively.

From an investor perspective, it would therefore be well worth keeping an eye on the real cost drivers and also to investigate which technological approaches could successfully address these indications. In this context, mRNA technology certainly plays a role, as it also has potential for the treatment of cardiovascular and autoimmune diseases as well as addressing aging, for example.

* The article was first published at Plattform Life Sciences, issue 3/2023.